Africa: U.S. Trade Wars With China – and How They Play Out in Africa

Since taking office, US president Donald Trump has implemented policies that have been notably hostile towards China. They include trade restrictions. Most recently, a 20% tariff was added to all imports from China and new technological restrictions were imposed under the America First Investment Policy. This isn’t the first time US-China tensions have flared. Throughout history the relationship has been fraught by economic, military and ideological conflicts.

China-Africa scholar and economist Lauren Johnston provides insights into how these dynamics may also shape relations between Africa and China.

How has China responded to hostile US policies?

First, China tends to have a defiant official response. It expresses disappointment, then states that the US policy position is not helpful to any country or the world economy.

Second, China makes moves domestically to prioritise the interests of key, affected industries.

Third, China will sometimes impose retaliatory sanctions.

In 2018, for instance, China imposed a 25% tariff on US soybeans, a critical animal feed source. The US Department of Agriculture had to compensate US soybean farmers for their lost income.

Another example is how, following US tech sanctions, China took a more independent technology path. It has channelled billions into tech funds. The goal is to make financing available for Chinese entrepreneurs and to push technological boundaries in areas of US sanction, such as semiconductors. These efforts are backed up by subsidies and tax reductions. In some cases, the Chinese state will invest directly in tech companies.

More recently, China retaliated to the US trade war by announcing tariffs on 80 US products. China is set to place 15% tariffs on certain energy exports, including coal, natural gas and petroleum. An additional 10% tariffs will be placed on 72 manufactured products including trucks, motor homes and agricultural machinery.

Agricultural trade has been hard hit. The day the US announced a 10% tariff on Chinese imports, China announced “an additional 15% tariff on imported chicken, wheat, corn and cotton originating from the US”. Also, “sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products will be subject to an additional 10% tariff”.

How have these Chinese responses affected Africa?

We can’t say for certain that China’s response to US trade tensions has explicitly affected its Africa policy, but there are some notable coincidences.

Less than one month after Trump’s return to the White House in 2025, and soon after the first tariffs were slapped on China’s exports to the US, China announced new measures to foster China-Africa trade efforts. The policy package aims to “strengthen economic and trade exchanges between China and Africa.”

This is the latest in a series of Chinese actions.

In January 2018 trade hostilities began to escalate after Trump imposed a first round of tariffs on all imported washing machines and solar panels. These had an impact on China’s exports to the US.

Later the same year, China imposed 25% tariffs on US soy bean imports and took steps to reduce dependence on US agricultural products. China also took steps to expand trade with Africa, agricultural trade in particular.

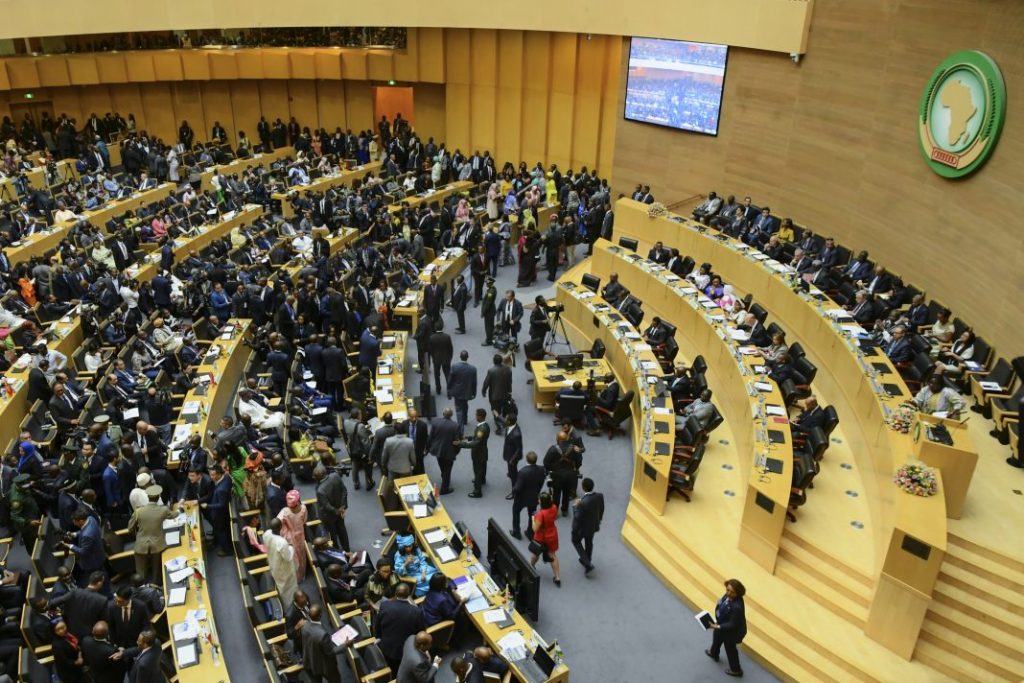

In September 2018, Beijing hosted the Forum on China and Africa Cooperation summit, a triennial head of state gathering. It was announced that China would set up a China-Africa trade expo and foster deeper agricultural cooperation. In the days after the summit, China’s Ministry of Agriculture and Rural Affairs was already acting on this. A gathering of African agricultural ministers took place in Changsha, Hunan province.

Hunan province has since taken centre stage in China-Africa relations. It’s now the host of a permanent China-Africa trade exhibition hall and a larger biennial China-Africa economic and trade exhibition (known as CAETE).

Hunan also hosts the pilot zone for In-Depth China-Africa Economic and Trade Cooperation. The zone has numerous initiatives designed to overcome obstacles to China-Africa trade and investment, like support in areas of law, technology and currency, and vocational training.

Finally, the zone is located in a bigger free-trade zone that is better connected to Africa by air, water and land corridors. African agricultural exports to China pass through Hunan, where local industry either uses these imports or distributes them across the country to retailers.

Companies in Hunan are well placed to play a key role in supporting China-Africa trade, capitalising on the opportunities left by China-US hostilities.

Hunan’s agritech giant Longping High-Tech, for instance, is investing in Tanzanian soybean farmers.

Hunan is also home to China’s construction manufacturing and electronic transportation frontier. This includes global construction giant Sany, which produces heavy industry machinery for the construction, mining and energy sectors. China’s global electronic vehicle manufacturing BYD and its electronic railway industry are also in Hunan. They have deep and increasing interests in Africa and can also support China’s key minerals and tech race with the US.

As US-China hostility enters a new era, what are the implications for China-Africa relations?

As my new working paper sets out, African countries are, for example, responding to the new opportunities from China.

At the end of 2024, while the world waited for Trump’s second coming, various African countries made moves to strengthen economic ties with China, Hunan province especially.

In December 2024, Tanzania became the first African country to open an official investment promotion office in the China-Africa Cooperation Pilot Zone in Changaha.

In November 2024, both the China-Africa Economic and Trade Expo in Africa and the China Engineering Technology Exhibition were held in Abuja, Nigeria. Equivalent events were hosted in Kenya.

Early in 2025 in Niamey, Niger, a joint pilot cooperation zone was inaugurated , and which is direct partner of the China-Africa Pilot zone in Hunan.

As China moves away from US agricultural produce, for instance, African agricultural producers can benefit. Substitute African products and potential exports will enjoy a price boost, and elevated Chinese support.

China’s newly elevated interest in African development and market potential will bring major prospects. The question will be whether African countries are ready to grasp them, and to use that potential to foster an independent development path of their own.

By The Conversation Africa