US-China rivalry

Tackling that challenge and its consequences was one of the main reasons for this week’s visit by US Vice-President Kamala Harris to three African countries. It is a visit that comes with big commitments of financial support to Tanzania and Ghana.

There is a growing rivalry with China for influence in the continent, whose abundance of natural resources include the metals, such as nickel, crucial for the batteries needed for technology such as electric cars.

Speaking in Ghana’s capital, Accra, she said “America will be guided not by what we can do for our African partners, but what we can do with our African partners”.

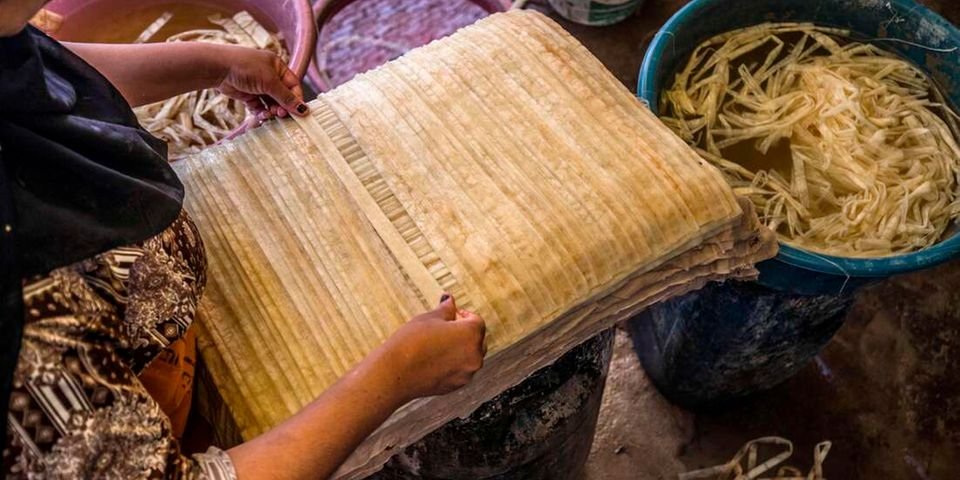

While highlighting a new nickel processing facility in Tanzania Ms Harris said the project would be supplying the US and other markets by 2026 and that it would “help address the climate crisis, build resilient global supply chains, and create new industries and jobs”.

That collaborative approach was praised by Mr Malpass who said the competition between the world’s two biggest economies was “maybe healthy for developing countries” as it provided different options.

“What I encourage strongly is that they be transparent in their contracts. That’s been one of the problems; if you write a contract and say ‘but don’t show it to anybody else’, that’s a minus. So get away from that.”

There was also a warning that “for governments in Africa, they shouldn’t be offering collateral as an inducement to make a loan, because it locks it up for generations. That’s been happening with China.”

Beijing has become one of the biggest sources for loans to developing economies in recent years. A new study led by the Kiel Institute for the World Economy shows that globally China lent $185bn (£150bn) in bailouts to 22 countries between 2016 and 2021.

China refutes suggestions that it is exploiting other countries with its financial support.

At a press conference this week Foreign Ministry Spokesperson Mao Ning said China “respects the will of relevant countries, has never forced any party to borrow money, has never forced any country to pay, will not attach any political conditions to loan agreements, and does not seek any political self-interest”.

Mr Malpass said the problems were not unique to Chinese financing but things were improving.

“If you think of the history of Western lending, sometimes it’s not for the full benefit of the people in the countries [being lent to]. Even World Bank loans haven’t always been for the best that could have been done in a country.”

“So what we’re trying to do, and I think everyone should be trying to do, is improve the quality of the lending.

“One of the techniques is to unbundle the loan, meaning if there’s an investment project, let’s say you’re building a train, describe the project and what the cost will be. And then separately, arrange the financing.

“If you bundle them together, it makes it very hard to know, am I getting a good deal on the train or on the financing.”